Customers

A year in review: our customers in 2022

20 Dec 2022

When we started Funding Options in 2011, we set out to transform the business finance market for the better. We knew that SMEs – who are the lifeblood of the UK economy – often struggle to secure the finance they need to plan, trade and grow with confidence. Fast forward to today and we’re proud to say that things are changing.

We’ve created a year in review to share with you. For us, it’s all about our customers and their journey to getting funding. Let’s take a look!

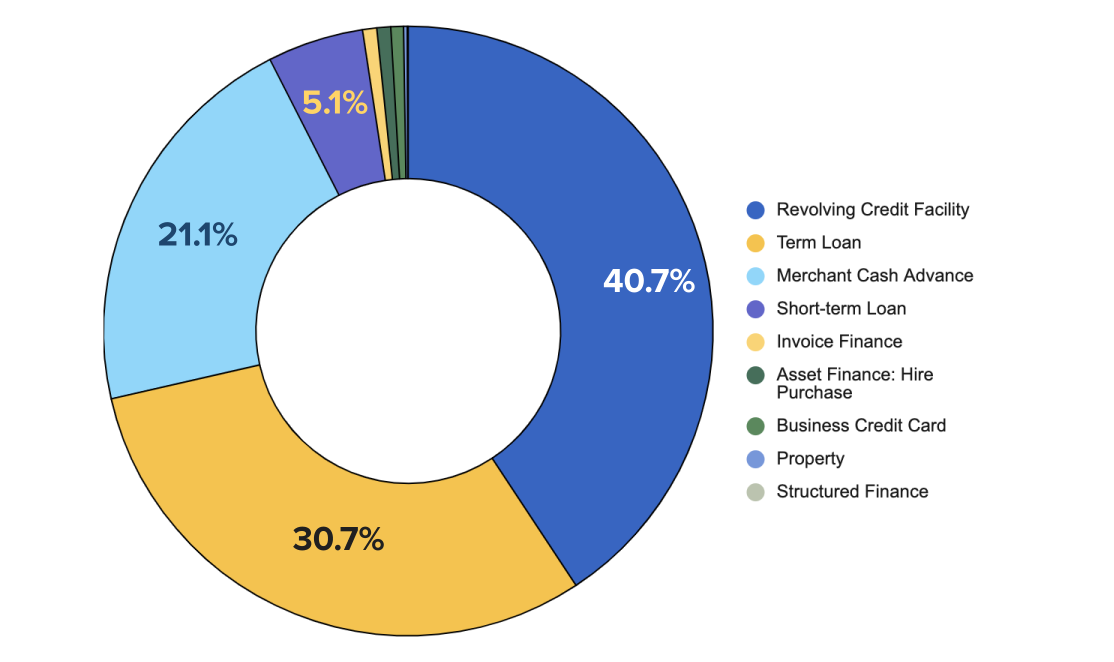

1. Revolving credit facility: top product in 2022

The most popular product of 2022 was the revolving credit facility, followed by term loans and merchant cash advance. This is unsurprising: revolving credit facilities are among the most flexible business finance options on the market today.

Unlike a term loan where you borrow a fixed sum and repay it – plus interest – in a set timeframe, a revolving credit facility enables you to withdraw money, use it to fund your business, repay it and then withdraw it again when you need it.

Designed for short-term funding needs, they can last from anywhere between six months to two years, and there’s the potential to extend that even further if the lender agrees.

Most popular business finance products in 2022.

2. Consulting: top industry in 2022

The most popular industry that used us to find funding was Consulting, followed by Retail and Hospitality. Consulting firms offer vital support to their clients, providing them with expert, industry-specific advice, and designing solutions to challenges that they don’t necessarily have the knowledge or resources to be able to handle in-house.

Industries we worked with over 2022.

A consulting firm might require business finance for a number of reasons, including to fuel growth or as a short-term cash injection solution. If you run a consultancy firm and invoice clients for work, did you know that you might be eligible for invoice finance?

Invoice finance enables you to use your unpaid invoices as security for business finance. So, instead of waiting 30 to 90 days to get paid, you can secure a large percentage of the value of your invoices straightaway, in some cases within 24 hours.

3. 23 minutes: from funding application to cash in the bank

We’re excited to say that our 2022 Funding Cloud record is in just 23 minutes. Our customer submitted their application at 10:22AM and received the funding into their account at 10:46AM – whew!

That means, with Funding Cloud, it's possible to apply and receive finance all within your lunch break.

Funding Cloud is our multi award-winning data-driven platform that is bringing unparalleled scale and speed to the SME finance sector. It connects lenders with businesses to facilitate fast, accurate and secure access to funding at scale.

Within seconds, Funding Cloud can accurately validate a business’ profile and match it to the industry’s largest lender network, presenting back instant offers and, in some cases, pre-approved offers in real-time. If you need funding in 2023 or even earlier, get ahead and start your simple, fast business application process now?

Use Funding Cloud4. May: top month in 2022

Our top month for business lending was May – that’s when we helped the most customers access vital funding.

A few things happened in May this year that had implications for the economy and businesses. For example, on May 5 the Bank of England raised the interest rate from 0.75 to 1.0%, which was the highest level since February 2009. It currently stands at 3%.

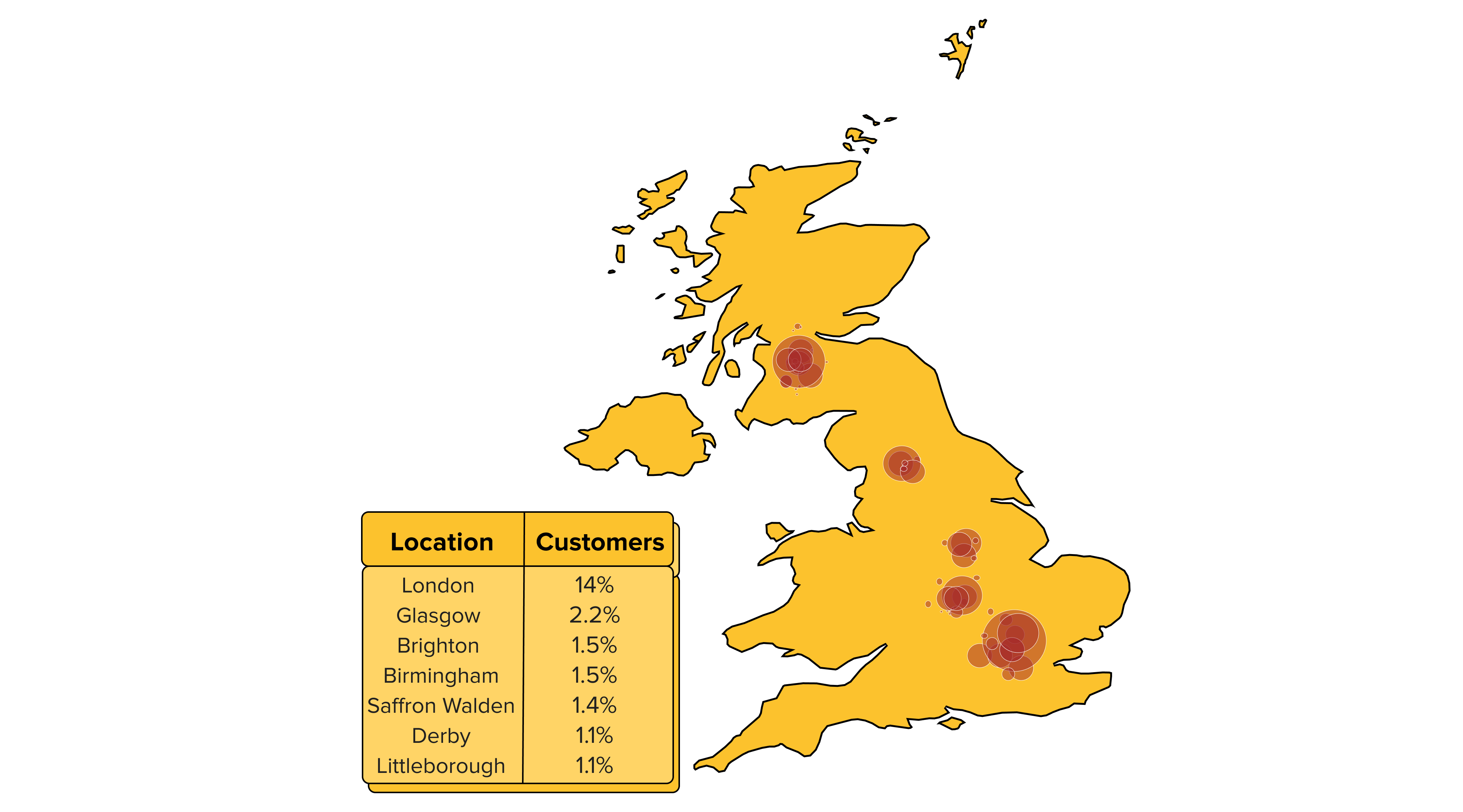

5. London: top location in 2022

The majority of loans that Funding Options helped to secure this year have been for businesses from London, followed by Glasgow, Brighton and Birmingham.

It’s no surprise that London comes in at #1: London had the highest rate of business creation in the first half of 2022. What’s more, the 2022 Global Startup Ecosystem Report placed London as the world’s number two startup alongside New York.

Meanwhile, Glasgow, Scotland’s largest city, is benefiting from major regeneration investment in its infrastructure and systems, particularly in the Clyde Gateway and ‘Creative Clyde’ area, making it an attractive location for startups and SMEs.

The majority of loans that Funding Options helped to secure in 2022 have been for businesses from these cities.

6. The grand total of SMEs to have been funded in 2022

…And finally, we've helped no less than 1,474 businesses gain access to funding this year. Needless to say, we’re looking forward to helping our customers plan, trade and grow with confidence into 2023 and beyond. Watch this space!

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.