Advisory

Build a digital future by funding your advisory proposition

27 Sept 2021

On the 27 September 2021, our Head of Advisory Thomas Boyd and Advisory Partnership Manager Steve Whelan hosted a webinar in partnership with the IFA to discuss how accountants, business consultants and practitioners could build a digital future by adding funding to your advisory proposition.

Our joint webinar with the IFA, Build a digital future by adding funding to your advisory proposition is now available on-demand here.

As a recap, the webinar covered:

1. What is advisory and how can you grow your firm by offering it?

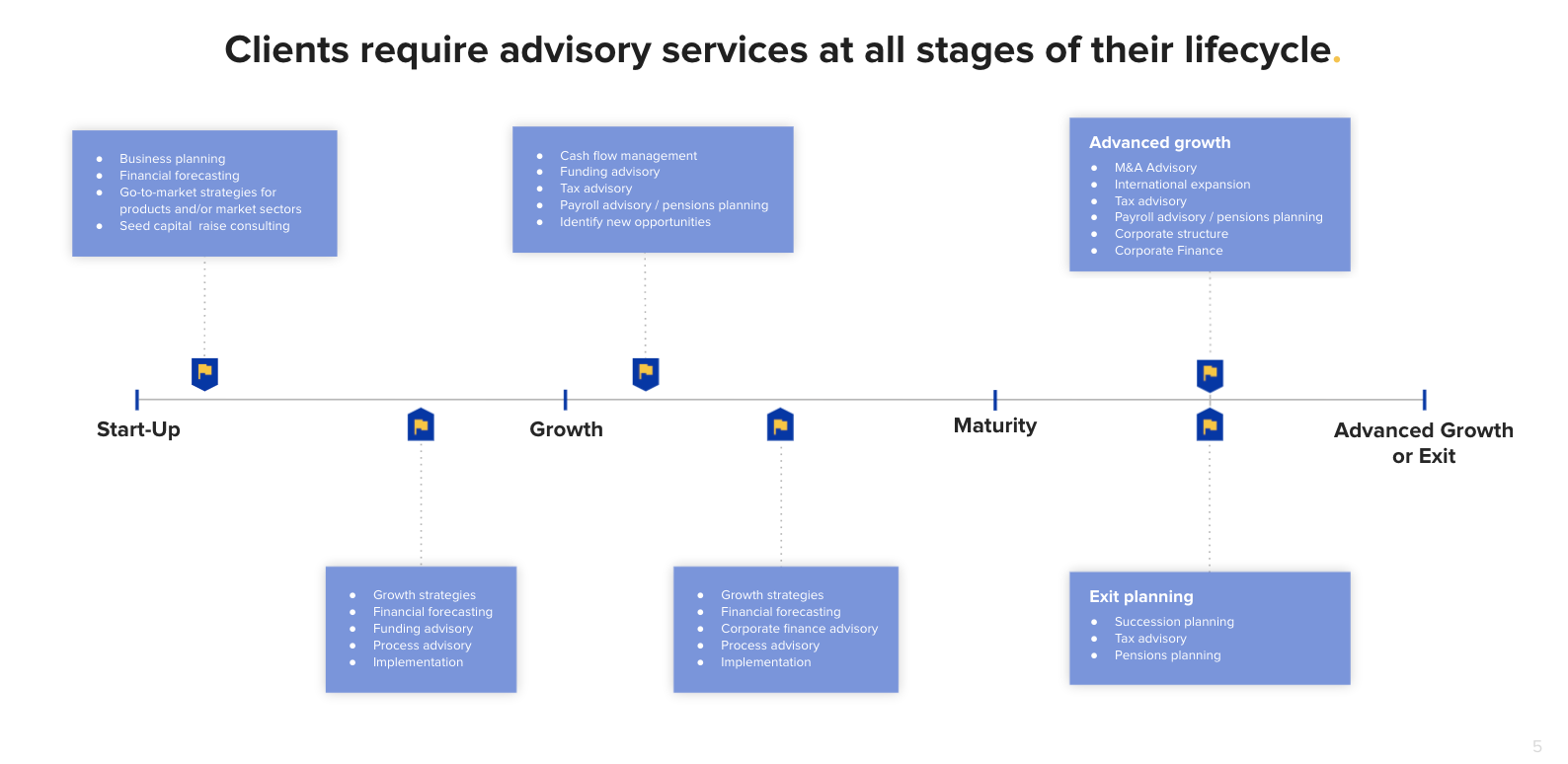

The Advisory Lifecycle

Advisory, or advisory accounting, refers to an accounting approach that provides accounting services alongside value-added services like strategy and consulting

Advisory, is one of the three levels of the accounting pyramid that most accountants offer

Why you should accelerate your transition towards becoming an advisory led firm

You can add value to your client’s decision making by translating their data into a tangible narrative

You can become the trusted advisor to a pool of thriving & growing businesses

Clients require advisory services at all stages of their lifecycle

2. How to speak to your clients about business finance

Set out clear expectations early in your relationship with clients about the additional services you offer

Use digital tools to facilitate your conversations. Real time monitoring of cash flow allows you to flag when external funding may be required

Focus on true strategy planning that centres around implementation instead of just goal setting

Collaborate with key trusted partners. You do not need to be an expert on all things business finance.

3. How to build a digital future by adding funding to your advisory proposition

Partner with Funding Options to build funding into your advisory proposition.

4. Our new advisory platform - Connect

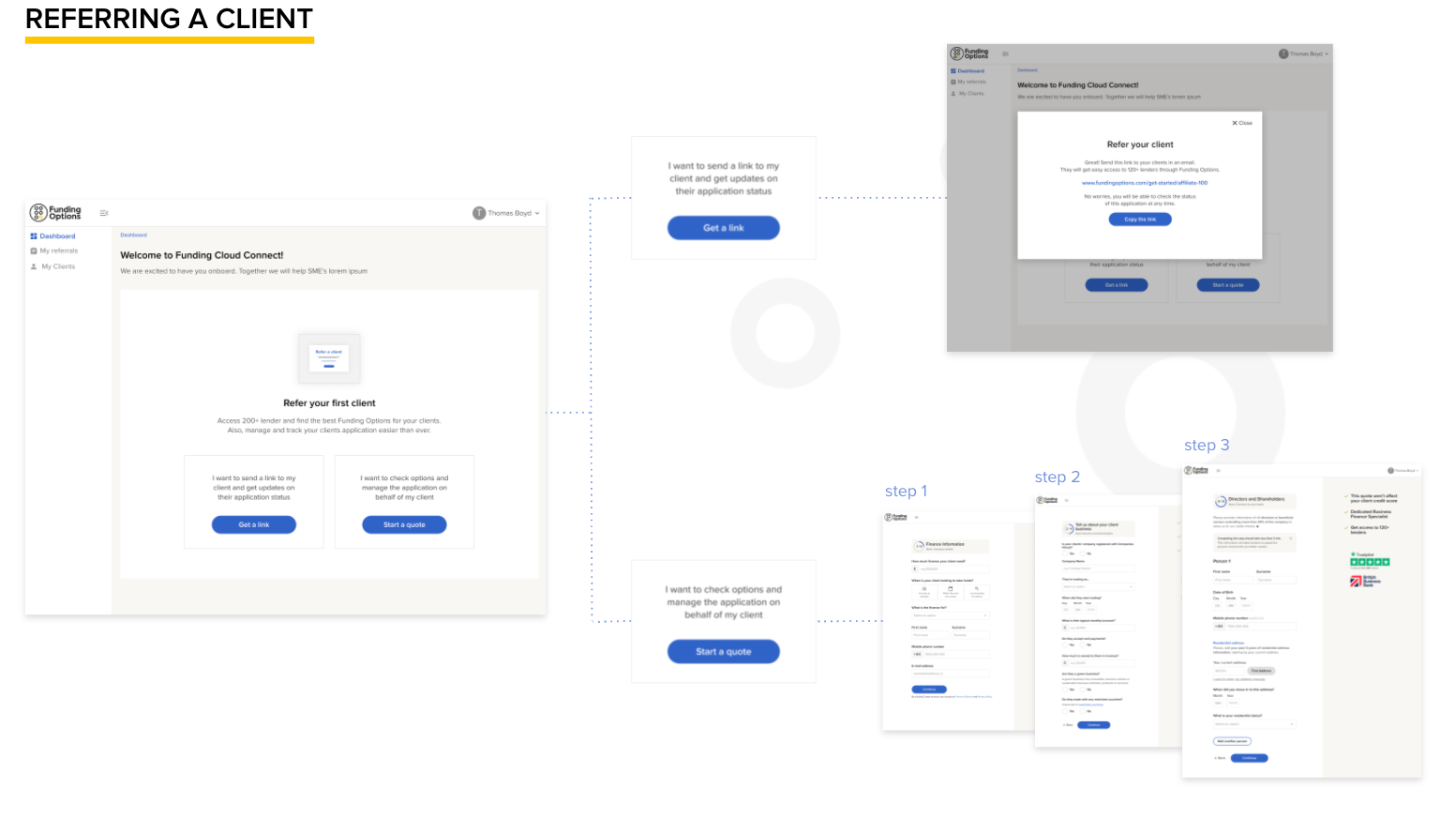

Referring a client to Connect

Apply online to become a partner

Create your Connect account designed especially for advisory partners

Refer a client using your personalised link

Manage and track your customer referrals through a dedicated dashboard

If you missed the webinar or want to watch it in full again, you can find it here.

Alternatively reach out to our Advisory team here if you have any questions relating to becoming an Advisory partner with us.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.